All Categories

Featured

Table of Contents

Term policies are additionally frequently level-premium, yet the excess amount will certainly remain the same and not grow. One of the most typical terms are 10, 15, 20, and thirty years, based on the requirements of the insurance holder. Level-premium insurance policy is a sort of life insurance coverage in which costs stay the same rate throughout the term, while the amount of coverage offered rises.

For a term plan, this suggests for the size of the term (e.g. 20 or 30 years); and for an irreversible plan, until the insured passes away. Over the lengthy run, level-premium repayments are typically a lot more cost-effective.

They each look for a 30-year term with $1 million in coverage. Jen gets a guaranteed level-premium plan at around $42 per month, with a 30-year perspective, for a total amount of $500 each year. Yet Beth figures she might only require a strategy for three-to-five years or till complete settlement of her current financial debts.

In year 1, she pays $240 per year, 1 and around $500 by year 5. In years 2 with 5, Jen proceeds to pay $500 per month, and Beth has paid a standard of just $357 each year for the exact same $1 countless protection. If Beth no much longer needs life insurance policy at year five, she will certainly have conserved a great deal of cash about what Jen paid.

What is 20-year Level Term Life Insurance? An Essential Overview?

Every year as Beth obtains older, she encounters ever-higher yearly costs. Jen will continue to pay $500 per year. Life insurance firms are able to give level-premium policies by essentially "over-charging" for the earlier years of the policy, gathering greater than what is required actuarially to cover the danger of the insured passing away throughout that very early period.

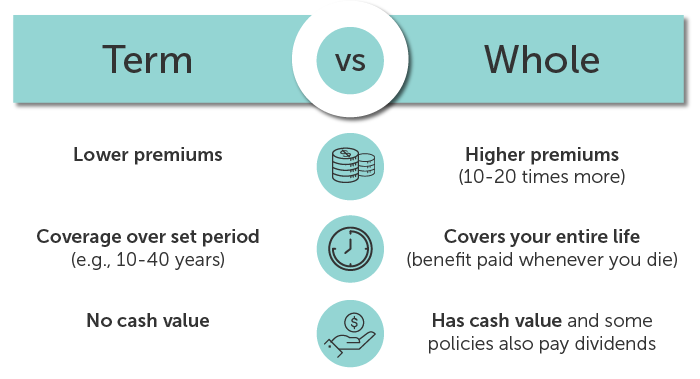

Long-term life insurance coverage establishes money value that can be borrowed. Policy finances accumulate interest and unpaid policy financings and passion will decrease the survivor benefit and cash money worth of the policy. The amount of money value available will normally rely on the sort of permanent policy bought, the quantity of protection acquired, the size of time the policy has actually been in force and any kind of outstanding policy car loans.

A complete declaration of insurance coverage is found just in the plan. Insurance coverage plans and/or associated cyclists and functions might not be offered in all states, and plan terms and problems might differ by state.

Degree term life insurance policy is the most uncomplicated method to get life cover. In this post, we'll describe what it is, how it works and why level term may be right for you.

The Basics: What is What Is A Level Term Life Insurance Policy?

Term life insurance policy is a kind of policy that lasts a certain length of time, called the term. You select the size of the plan term when you first obtain your life insurance policy. It might be 5 years, two decades and even a lot more. If you pass away throughout the pre-selected term (and you've kept up with your costs), your insurance company will certainly pay a round figure to your nominated beneficiaries.

Choose your term and your quantity of cover. Select the plan that's right for you., you know your costs will certainly stay the exact same throughout the term of the plan.

Life insurance covers most conditions of fatality, however there will be some exemptions in the terms of the policy.

After this, the policy ends and the surviving companion is no longer covered. Joint policies are usually a lot more budget-friendly than single life insurance coverage policies.

What Is Level Premium Term Life Insurance Coverage and How Does It Work?

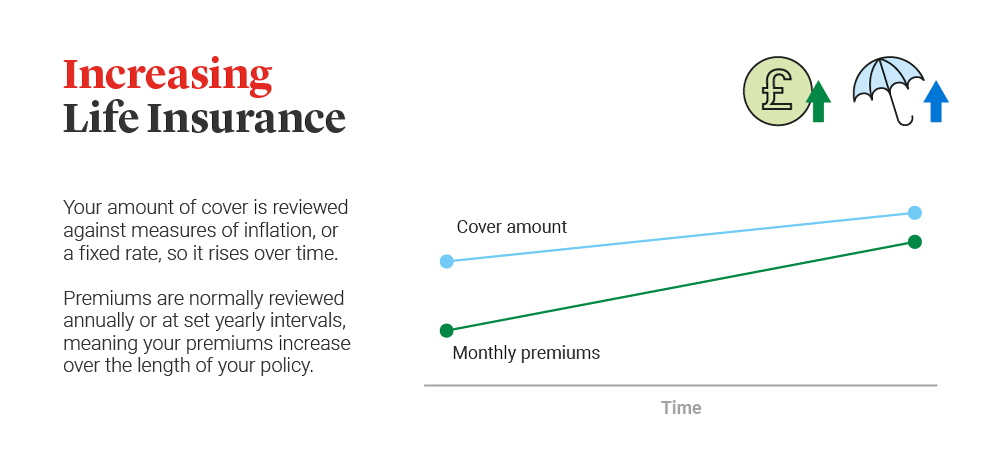

This safeguards the getting power of your cover amount against inflationLife cover is a fantastic thing to have because it gives monetary defense for your dependents if the most awful happens and you pass away. Your liked ones can also use your life insurance payout to spend for your funeral. Whatever they pick to do, it's fantastic assurance for you.

However, degree term cover is excellent for satisfying everyday living expenses such as house bills. You can likewise use your life insurance policy benefit to cover your interest-only home mortgage, settlement home loan, institution costs or any kind of other financial obligations or continuous repayments. On the various other hand, there are some downsides to level cover, compared to other types of life policy.

Term life insurance coverage is a cost effective and straightforward option for many individuals. You pay premiums each month and the protection lasts for the term size, which can be 10, 15, 20, 25 or thirty years. Term life insurance with level premiums. What takes place to your costs as you age depends on the kind of term life insurance policy coverage you get.

What is Level Premium Term Life Insurance Policies? All You Need to Know?

As long as you continue to pay your insurance coverage premiums each month, you'll pay the exact same price throughout the entire term size which, for lots of term policies, is commonly 10, 15, 20, 25 or three decades. When the term ends, you can either choose to end your life insurance policy coverage or renew your life insurance coverage policy, typically at a higher price.

As an example, a 35-year-old woman in superb wellness can buy a 30-year, $500,000 Sanctuary Term plan, issued by MassMutual beginning at $29.15 monthly. Over the next 30 years, while the plan is in area, the cost of the protection will not change over the term duration - Decreasing term life insurance. Let's face it, many of us don't such as for our expenses to grow over time

Your level term rate is established by a variety of elements, the majority of which are related to your age and health. Various other variables include your details term plan, insurance policy provider, advantage amount or payout. Throughout the life insurance policy application procedure, you'll respond to questions regarding your wellness background, consisting of any type of pre-existing problems like a crucial ailment.

Latest Posts

Burial Insurance Rates For Seniors

Burial Insurance In Georgia

Final Expense Plan Reviews